Around the Covid-19 epidemic, something changed about self-employment among Indians, if we are to believe the various rounds of the Periodic Labour Force Survey (PLFS). PLFS captures self-employment through various questions. Broadly, every individual from the surveyed household is asked about usual status and current weekly status. For this article, we will focus on usual status. For usual status, information is further divided in principal status and subsidiary status. As the name reflects, principal usual status is a broad description of the major engagement of the individual in preceding 365 days at the date of interview. It is this principal usual status which will be the key marker that we will follow.

Figure 1: Change in self-employment in India

In 2021-22 and 2022-23 rounds of PLFS, we observe a growing trend of men workers being an employer, for both rural as well as urban India. In case of women, being an employer is a much less likely outcome as compared to men and that has not changed over the 6 rounds. There is a small uptick in the urban women employers while no change for rural women employers. But for rural women, there is a growing trend observed for own account workers as a proportion of the labour force.

In the article, we try to see in which states of India these changes are more pronounced. To keep the article focused, we will be looking at changes in ‘employers’, which is the closest case to entrepreneurs as per the PLFS classification. We will also limit the age group which we will consider. Only those who are in the labour force (workers) and within age 15-64 are considered for the analysis in this article.

Figure 2 shows how rural men employers as a fraction of rural men workers have changed across the states of India. Some small states and states with no or negligible rural part are omitted for representational need. The striking fact of Figure 2 is the tremendous rise in employers in Assam as per the latest round of PLFS (2022-23). Figure 3 is a reproduction of Figure 2 except Assam.

Figure 3 is interesting. First, it shows that the states of Kerala and Tamin Nadu have much larger fraction of rural men workers as employers, as compared to other states. On the other extreme, are states like Bihar, Jharkhand, Madhya Pradesh, Rajasthan, Uttar Pradesh, and Uttarakhand. The correlation of this pattern with typical discourse in state level development inequalities in India is obvious. For Kerala, there is some increase in the already high fraction, seen in the last two rounds. Interestingly, Gujarat, which is a land of entrepreneurship in popular imagination, does not have the highest proportion among states and for rural men workers in Gujarat, proportion of being an employer seems to be falling. The states where we see sustained rise in the proportion of employers among rural men workers are Odisha, Punjab, and West Bengal. Haryana and Telangana are also part of this list with a considerable spike noted in the last round for both these states. A very weak or irregular trend of rise is observed for Andhra Pradesh and Maharashtra as well. Overall, Figure 3 allows us to conclude that the recent trend of increase in the proportion of employers among rural men workers in India, an indicator of entrepreneurship activity, is not observed across all the states. The apparent national rise is due to certain states.

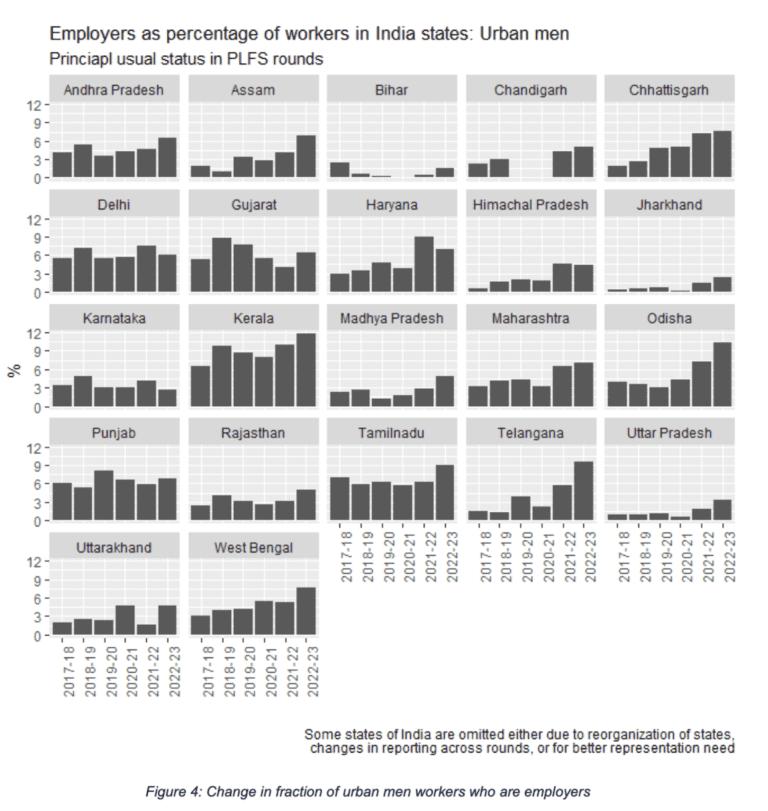

Figure 4 shows trends very similar to what we observed for employers among rural men workers (Figure 3). Kerala has a high proportion of employers for urban men workers as well and it shows a rising trend in latest rounds. Along with Odisha and West Bengal, Chhattisgarh too has a rising trend of employers among urban men workers. Jharkhand and Uttar Pradesh have low proportions but there is some uptick in latest rounds.

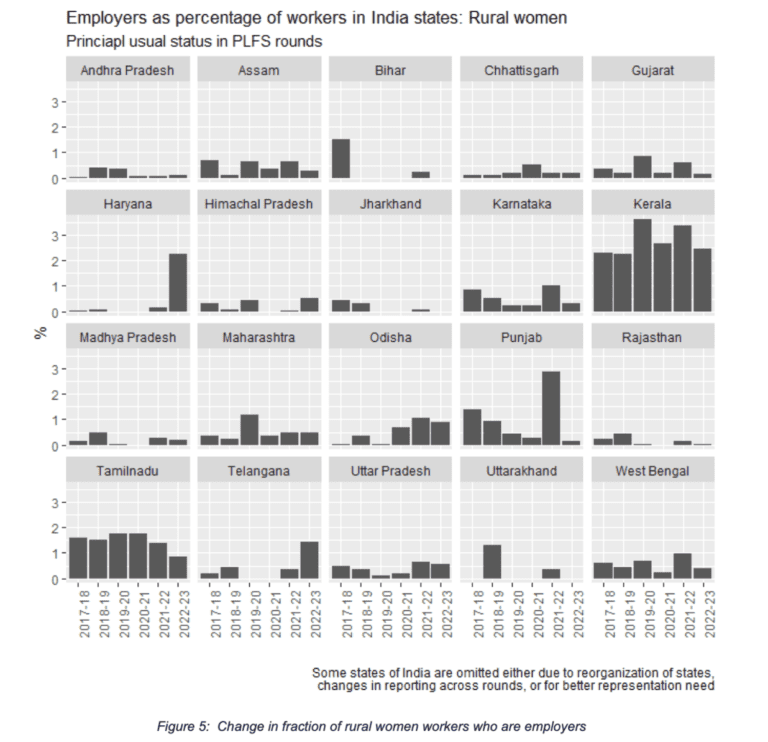

Figure 5 shows that there are no such signs of increase in proportion of employers when it comes to rural women workers. The point to be noted from Figure 5 is that Kerala and Tamil Nadu also have a higher proportion of workers who are employers for rural women as compared to other states. But overall, the proportion is lesser than what is observed for rural men workers.

Figure 5 also allows us to see the danger of using PLFS to learn about entrepreneurs. In many state samples, rural women employers are a small number. This leads to large fluctuation in percentages. The case is best illustrated in the case of Bihar. The rural women worker sample is about 1300, which is not a small number. But the rural women employers were 26 in 2017-18, 11 in 2018-19, and then 4 in 2019-20. One could see how this has played out.

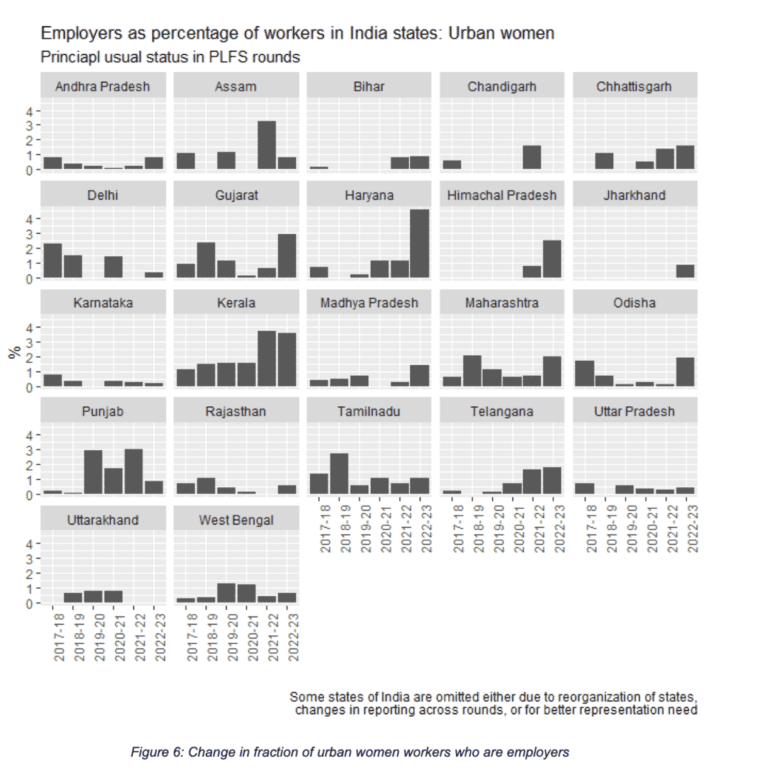

Figure 6, which is showing a state wise picture of the proportion of employers among urban women workers has some sudden increases, like Haryana or Himachal Pradesh or even Kerala. Chhattisgarh and Telangana have been showing a sustained trend of increase in the last 3 rounds or so. As mentioned earlier, often these are small numbers, so we must conclude with caution.

To conclude, we see that Kerala and Tamin Nadu are stand out states when it comes to male employers. Odisha and West Bengal are of interest due to recent changes for rural male workers. There are states like Assam and Haryana which have shown large changes which need to be examined more.

PLFS surveys are yet to prove as a doubtless piece of evidence when it comes to labour force characteristics in India. Also, the apparent rise in the proportion of employers is too recent to conclude of some structural change. Why we are interested in employers is because of their critical role in employment generation. An increase in the proportion of employers bodes well unless it reflects actions of those who cannot be in the workforce as employees. In next articles, we will examine more about the employers in the Indian economy through PLFS rounds and we will wait to check whether the apparent trend of increase in proportion of employers persists in forthcoming rounds of PLFS.