Nano entrepreneurs are a distinct segment within the Micro, small and medium enterprises (MSME). Despite their relatively small scale of operations, they have a huge impact on the economy. It is estimated that there are more than 10 million nano entrepreneurs in India employing more than 20 million people which is 2.5% of the working population. (Goel & Buteau, 2023). However, most of these entrepreneurs are part of the informal economy and therefore, the main obstacle in their growth is lack of formal credit. Out of these 10 million nano entrepreneurs, only 5% have access to formal credit and the other 95% face difficulties in growing due to lack of funds. (Goel & Buteau, 2023). Microfinance can be used as a tool to overcome this barrier to growth.

The average ticket size of INR 2 lakh in the current financial year, makes microfinance the largest potential credit segment worth INR 2 trillion. (Goel & Buteau, 2023) This figure is growing at 30% CAGR from 2014 to 2021 and is expected to grow by 24%-26% in FY24 followed by a growth rate of 23%-25% in FY25. (ICRA, 2023).

The emergence of Microfinance can be dated back to 1969 when the Indira Gandhi led government nationalised 14 private banks. The main reason behind this move was to provide credit at subsidised interest rates to the rural poor because the majority of credit advanced could not be repaid and state owned banks were burdened with huge amounts of bad loans. (Aiyar, 2019) Therefore, a market oriented approach was needed which led to the formation of microfinance groups like the Self-Employed Women’s Association (SEWA), which is regarded as the first microfinance institution in india.

Some MFIs tried to solve this problem using the Grameen Model of extending Microfinance. The Grameen Model was developed by the Nobel Laureate Prof. Muhammad Yunus in the 1970s to provide credit to the rural parts of Bangladesh. The Grameen model has inspired the creation of regional rural banks which has been the backbone of development in the hinterland of the country. The first regional rural bank was set up in 1975 in Uttar Pradesh.

In the 1970s, more than 60% of the workforce was reneged in agriculture and worked in the rural parts of the country. Since the Grameen model was mainly used in the rural areas, it was an instant hit. In less than 15 years from the establishment of the first regional rural bank, more than 85 regional rural banks were set up. However, they soon faced funding issues and could not bear any Non Performing Assets.

A 1979 RBI report by B. Sivaraman, former member of the Planning Commission, highlighted the importance of formal credit to the rural economy. This report along with the poor state of the rural economy led to the formation of NABARD (National Bank for Agriculture and Rural Development) in 1982. NABARD was regarded as the apex development financial institution in India. NABARD was responsible for providing credit to companies having an investment of up to Rs 20 lakh in plant and machinery.

To extend credit and other financial services to the rural households, NABARD launched the self help group – bank linkage programme in 1992. These self help groups were linked to a bank under the Bank Linkage Programme (BLP) which helped the groups borrow more and lend to their members. Since its launch, the SHG – BLP has touched 16.2 crore households through 134 lakh SHGs having total deposits of INR 58,893 crore as of 31st March, 2023. These numbers have made the Self Help Group – Bank Linkage Programme, the world’s largest microfinance programme. INR 1,45,200 crore of annual loan is advanced to these self help groups and banks have an outstanding debt of INR 188,079 crore as of 31st March, 2023. (NABARD, 2023). NABARD played a vital role in expanding the SHG model by linking them to sources of formal de-credit.

Another model, which NABARD was instrumental in establishing in 2004 was the JLG model of extending credit. Joint Liability Group (JLG) is an informal group consisting of 4-10 members who seek loans against mutual guarantee. The joint liability of repaying the loans instilled discipline in the borrowers and safeguarded banks against bad loans. All the members of a joint liability group are equally liable and stand guarantee to the loan. If any of the members defaults, then the other members have to pool in money and repay the obligation. This ensures better accountability and security for the MFI and has helped the industry reduce its NPAs. The JLP of NABARD has helped 257.92 lakh groups since its inception. The cumulative amount of loan disbursed in the last two decades stands at INR 4,59,310.48 crore.

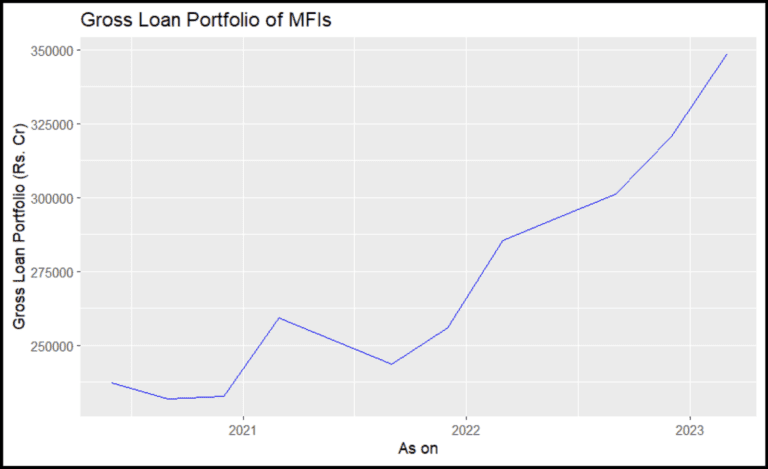

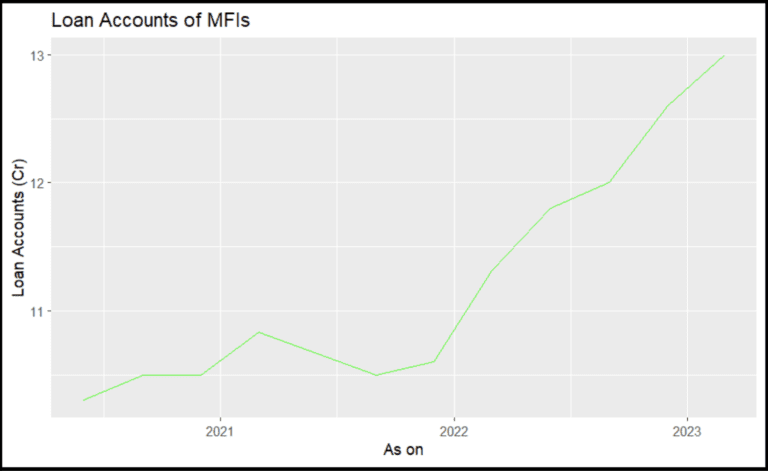

All the above models of extending Microfinance were very successful but to achieve economies of scale in lending operations, NABARD has to use the MFI led approach. The MFI led approach is gaining momentum in recent years which can be seen graphically.

Currently, there are 211 MFIs serving more than 10 crore clients. MFIs are further divided into three tiers based on the number of clients they serve. MFIs serving more than 250,000 clients are termed as Tier 1. MFI serving 50,000 to 250,000 clients are termed as Tier 2 followed by MFIs who serve less than 50,000 clients which are categorised as Tier 3. These MFIs operate a total of 22,428 branches spread across 608 districts in India. NBFC-MFIs were the largest provider of microcredit, accounting for 39.7% of total industry portfolio followed by banks who account for 34.2% of the total microcredit universe. The total outstanding portfolio as of 31st March, 2023 is INR 3.52 lakh crore. This portfolio of MFI is spread across the country and has penetrated into areas where traditional scheduled commercial banks could not reach. BIhar, Tamil Nadu, Uttar Pradesh, West Bengal and Karnataka are the leading 5 states in terms of outstanding portfolio of MFIs and account for 55% of the total outstanding portfolio of MFIs. These numbers show the effect MFIs have on the under-financed section of the society like women, unemployed youth, specially-abled people and the rural households.

The central bank supported Microfinance institutions by adding SHGs to the list of priority sector lending in 2011. RBI further introduced collateral free lending for these groups and permitted banks to lend without any knowledge on how the money is going to be used by these groups. RBI in 2022 revised the definition of microfinance loan as a collateral free loan given to a household having an income of up to INR 3 lakh. The earlier definition specified the upper limit for a microfinance loan at INR 1.2 lakh for rural borrowers and INR 2 lakh for urban borrowers. (RBI, 2022)

High risk is involved in MFIs

As of now the Portfolio at Risk (PAR). stands at 10.5% as of March, 2023 which is more than double the NPAs of the overall banking system.

Though government from time to time have launched institutions and policies for example, SIDBI in 1990, MUDRA yojna in 2015, PMJDY in 2014, and the latest example of The PM Street Vendor’s Atma Nirbhar Nidhi (PM SVANidhi), which is a microcredit policy for street vendors. All these in a way help MFIs in lowering the risks of lending. Yet,

The high risks involved in lending to Nano entrepreneurs results in MFIs charging an abnormally high interest rate which can trap them in a debt circle. Although RBI has given MFIs the freedom to set the interest rates charged on Microfinance loans, they have also said that the rates should not be exploitative. RBI also has said that MFIs should put in place a board approved policy regarding pricing of microfinance loans, a ceiling on interest rate and all other charges applicable to microfinance loans. The MFI should disclose all this information to a prospective client in a simplified manner.

For instance, SKS Microfinance which was the biggest Microfinance lender in the state of Andhra Pradesh was accused of being responsible for 200 suicides committed by its borrowers. SKS was accused of sending debt collectors to the borrowers who had their loans overdue and forcing them to mortgage their personal belongings to repay the loan. SKS Microfinance denied any wrongdoings and said that all allegations made against it were baseless and false. (Finch & Kocieniewski, 2022)

Recommendations

The RBI may push MFIs to operate in a fair and transparent manner. It should consider introducing interest rate caps instead of using the subjective term usurious. The RBI along with the government can encourage more companies to enter the MFI industry which will increase competition and benefit the clients in the form of lower cost of loans. The government with the help of regulators may increase financial literacy among prospective clients so that they are better able to understand the terms and conditions of the loan agreement. In order to achieve profitability with considerable social impact, it is important that all stakeholders in microfinance work in a collaborative manner.

Microfinance can help Nano entrepreneurs be the engine of growth in the Indian economy.

Bibliography

– By Hrishikesh Jain